The growing trend of digital transformation in financial institutions has banks of varying sizes scrambling to adopt new services and technologies across the board. Kavan Choksi points out that digital transformation in banking majorly entails the shift to providing online and digital services. It also involves the expansive number of backend changes needed to support this transformation. Many banks do make the mistake of taking on multiple separate digital initiatives and ultimately struggle to compete with digital-native solutions. Hence, digital transformation in banking should have a top-down approach and integrate robust digital systems.

Kavan Choksi underlines the advantages associated with digital transformation in banking

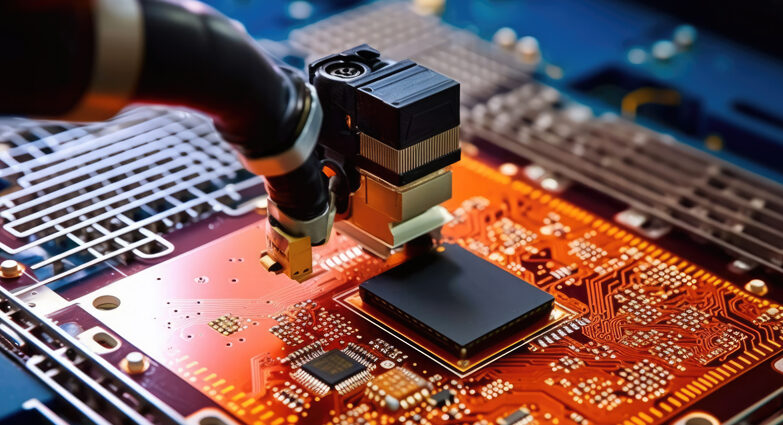

With brand new technologies disrupting how financial services businesses operate, the banking sector is undergoing a huge phase of digital transformation. Machine learning, robotics, and artificial intelligence are particularly responsible for pivoting this industry into a new digital world.

Here are some of the major ways in which banks especially can benefit from digitally transforming core systems:

- Increased customers: In the contemporary age, digitalization has become critical to increase the customer base and compete with peers, especially as today people expect increasingly faster results. Such raised expectations include customers demanding faster online banking solutions instead of the slow, traditional banking system.

- More efficient banking process: Efficiency is immensely vital in the market today where people prioritize accuracy and speed. Banking procedures at the moment are way more straightforward and fast in comparison to the traditional approaches owing to advanced digital analytics. Daily banking activities impacted by digital transformation include electronic signatures without the need for physical printing, deposits and transfers via mobile apps, and even automated bill payment.

- Data-driven decisions: The greater amount of information the management team of a bank can collect, the better decisions they can make. The most important business decisions are data-driven. This digitalization allows financial institutions to make such tough calls on the basis of real-time, accurate data so that they effectively align with customer needs.

- Minimal transaction costs: Digital transformation essentially promotes long-term cost efficiency by needing lesser ongoing investments compared to typical money exchange processes. For instance, digitalization has made cashless and online transactions more accessible and straightforward. This ultimately reduces the money spent on intermediary channels to provide cash from one party to another.

- Consolidated data and processes: Banks can make use of digital transformation to steer away from their legacy systems. These traditional systems often include a patchwork of disparate technologies that do not communicate data in the correct manner. Hence, banks must move to a more user-friendly centralized system that has simplified technology stacks, and involves less expensive and time-consuming maintenance.

- Improved reporting processes: Consolidated, real-time data can go a long way in improving how accurately and fast banks can handle reporting. Banks can keep a close eye on changing trends, promptly react and identify issues early in the process. Such additional insights would help the senior management of the bank to generate reports themselves that would otherwise need IT resources to compile and format. As generating such reports needs less workforce and time, a bank can move employees who were responsible for compiling this information to more analytical roles.

Kavan Choksi underlines that like the majority of industries, banking is undergoing a huge digital transition that shows no such sign of slowing down. Banks should explore the various digital transformations for creating a robust plan to help meet the ever-evolving customer expectations.